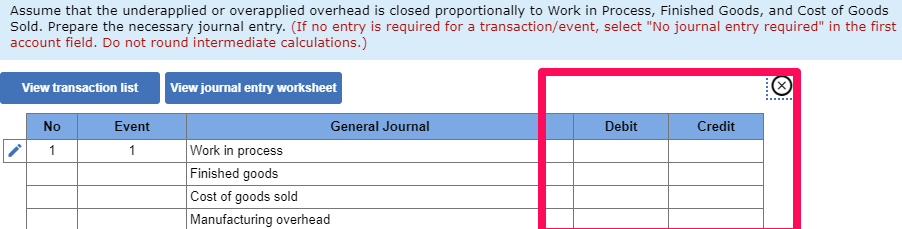

When overhead has been overapplied, the proper accounting is to debit the manufacturing overhead cost pool and credit the cost of goods sold in the amount of the overapplication. Doing so results in the actual amount of overhead incurred being charged through the cost of goods sold. In this case, the manufacturing overhead is underapplied by $1,000 ($11,000 – $10,000) as the applied overhead cost is $1,000 less than the actual overhead cost that has occurred during the accounting period. This journal entry is the opposite of the overapplied overhead as the remaining balance of the manufacturing overhead, in this case, will be on the debit side at the end of the accounting period instead. Hence, we need to credit the manufacturing overhead account instead to zero it out.

Impact on Financial Statements

In some periods, either the number of units produced will be greater than expected, or actual factory overhead costs will be lower than expected. In these situations, the use of a standard overhead rate will result in overapplied overhead. For example, on December 31, the company ABC which is a manufacturing company finds out that it has incurred the actual overhead cost of $9,500 during the accounting period. However, the manufacturing overhead costs that it has applied to the production based on the predetermined standard rate is $10,000 for the period. Sometimes, the actual overhead costs for a given period might be lower than what was estimated and allocated to the cost of goods or services, resulting in what is known as overapplied overhead. Overapplied overhead is manufacturing overhead applied to products that is greater than the actual overhead cost incurred.

AccountingTools

If the actual overhead had come to $270,000, the company would have charged off more than was necessary, and it would have “overapplied overhead” of $18,450. Note that the preliminary estimate of overhead costs, $250,000, doesn’t factor in here. In cost accounting, managing overapplied overhead is a critical task that can significantly influence an organization’s financial health. Overapplied overhead occurs when the allocated manufacturing overhead costs exceed the actual incurred costs during a specific period. This discrepancy can lead to distorted financial statements and misinformed decision-making if not properly addressed.

Financial and Managerial Accounting

Advanced software tools like SAP and Oracle can facilitate this process by providing real-time data and analytics, enabling more informed decision-making. For a company engaged in manufacturing, determining the value of inventory can be complicated. The company must account for the raw materials used in making its products, the direct labor required and any manufacturing overhead. If, at the end of the term, there is a debit balance in manufacturing overhead, the overhead is considered underapplied overhead. A debit balance in manufacturing overhead shows either that not enough overhead was applied to the individual jobs or overhead was underapplied. If, at the end of the term, there is a credit balance in manufacturing overhead, more overhead was applied to jobs than was actually incurred.

Our mission is to improve educational access and learning for everyone.

Textbook content produced by OpenStax is licensed under a Creative don’t overlook these 7 top tax breaks for the self Commons Attribution-NonCommercial-ShareAlike License .

Overapplied overhead is the result of the manufacturing overhead costs that are applied to the production process is more than the actual overhead cost that actually incurs during the accounting period. Underapplied overhead occurs when a business doesn’t budget enough for its overhead costs. This means the budgeted amount is less than the amount the business actually spends on its operations. For example, when a company incurs $150,000 in overhead after budgeting only $100,000, it has an underapplied overhead of $50,000. This is referred to as an unfavorable variance because it means that the budgeted costs were lower than actual costs.

- This helps management plan for cash flows throughout the year as well as establish goals.

- By maintaining accurate overhead allocation, companies can improve their financial reporting and make more informed strategic decisions.

- This proactive approach helps in making necessary adjustments before the end of the accounting period, thereby minimizing the impact on financial statements.

- This can distort the true financial position of the company, as the assets on the balance sheet appear more valuable than they are.

- Another significant implication is the need for continuous monitoring and variance analysis.

On the other hand, the company can make the journal entry for underapplied overhead by debiting the cost of goods sold account and crediting the manufacturing overhead account. At the end of the accounting period, the balance (whether it’s underapplied or overapplied) is usually cleared out to zero by adjusting the cost of goods sold or other relevant accounts. This way, the effects of under- or overapplying overhead do not carry forward into future accounting periods. The exact method for dealing with underapplied or overapplied overhead can depend on the specific accounting policies and practices of the company. Since overhead costs contribute to the production of inventory and are incurred throughout the production process, they must be allocated to each job. This means management can’t wait until the end of the period to add up all of the overhead costs incurred and allocate them to each job.

In this case, the manufacturing overhead is overapplied by $500 ($10,000 – $9,500) as the applied overhead cost is $500 more than the actual overhead cost that have occurred during the period. To correct for overapplied overhead, the excess amount is usually subtracted from the total cost of goods sold. If the amount of overapplied overhead is significant, it may be spread out across various inventory accounts and cost of goods sold in proportion to the overhead applied during the period. On the other hand, if the manufacturing overhead has a credit balance it means that that the applied overhead is more than the actual overhead.

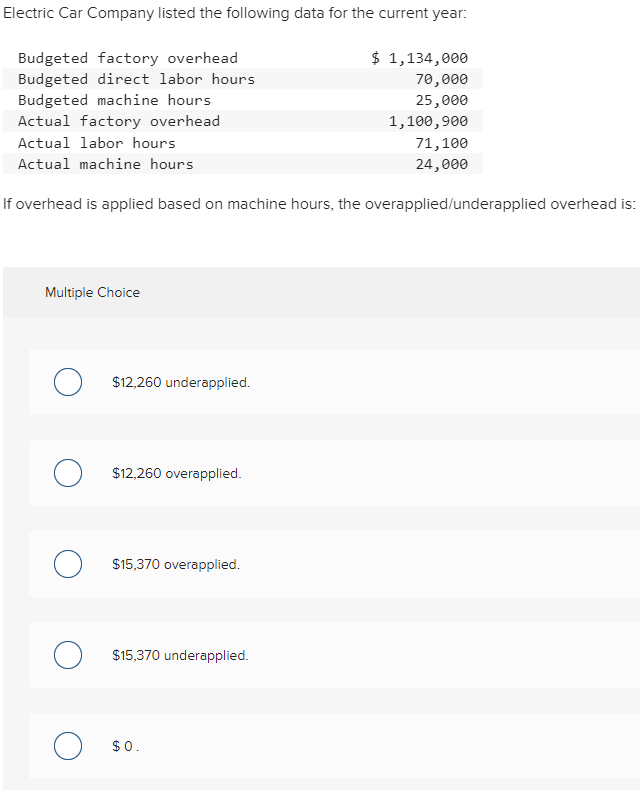

Actual overhead costs are found through company receipts for how much overhead costs. In an academic setting, problems from textbooks will often provide actual overhead costs per hour. If actual overhead costs per hour are given, then multiply those costs per hour by the number of hours worked.

Sometimes the estimate is more than the actual amount and sometimes it’s less than the actual amount. Overapplied overhead happens when the estimated overhead that was allocated to jobs during the period is actually more than the actual overhead costs that were incurred during the production process. In a sense, the production managers came in “under budget” and achieved a lower overhead than the cost accountants estimated. In this case, XYZ Corp. will need to make an adjustment to its accounting records to account for the overapplied overhead.

The management of overapplied overhead has far-reaching implications for cost accounting practices within an organization. Overapplied overhead often signals that the predetermined overhead rate may need adjustment. This necessitates a thorough review of the allocation bases, such as direct labor hours or machine hours, to ensure they accurately reflect the actual consumption of overhead resources. By refining these allocation methods, companies can achieve more precise cost distribution, leading to better pricing strategies and cost control. Carbonic Corporation uses an overhead application rate that resulted in $15,000 of excess overhead being charged to produced units during its March reporting period.