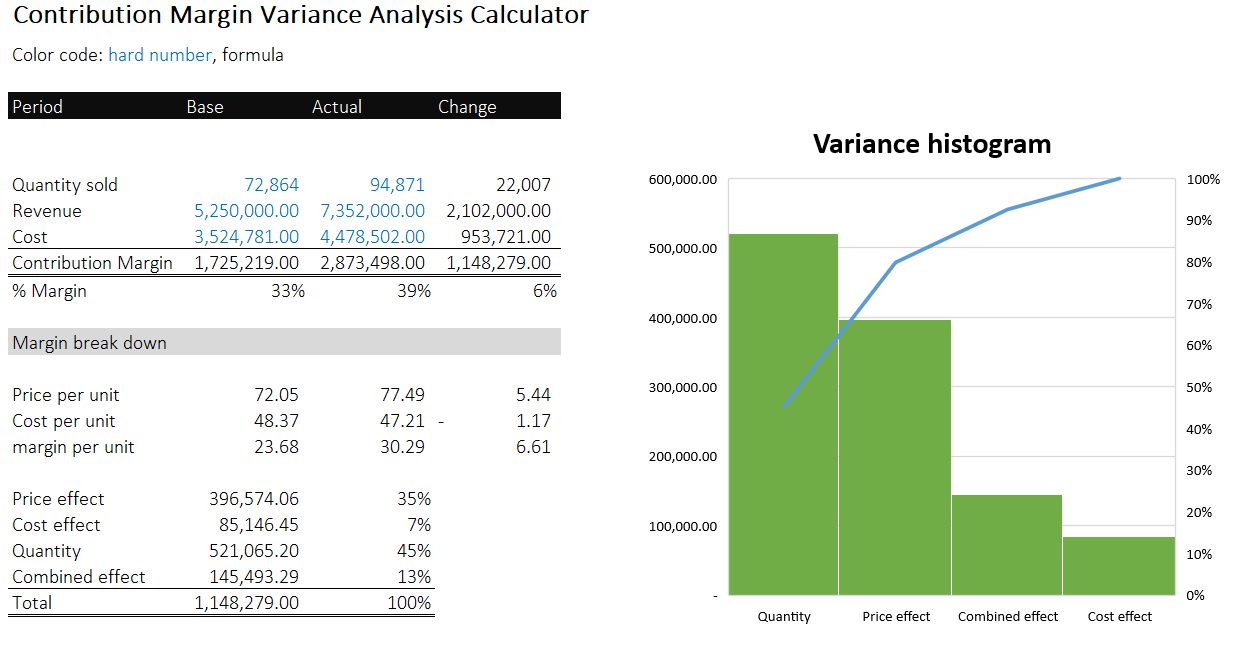

If the fixed costs have also been paid, the remaining revenue is profit. The resulting ratio compares the contribution margin per unit to the selling price of each unit to understand the specific costs of a particular product. In this example, the contribution margin for selling 100 units would be $2,000, indicating how much revenue is available to cover fixed costs and generate profit.

Formula and Calculation of Contribution Margin

In the same case, if you sell 100 units of the product, then contributing margin on total revenue is $6,000 ($10,000-$4,000). Where Total Contribution Margin is the sum of the contribution margins for all products sold. The contribution margin ratio is calculated as (Revenue – Variable Costs) / Revenue. A low margin typically means that the company, product line, or department isn’t that profitable.

How do you calculate the contribution margin?

Only two more steps remain in our quick exercise, starting with the calculation of the contribution margin per unit – the difference between the selling price per unit and variable cost per unit – which equals $30.00. In the next part, we must calculate the variable cost per unit, which we’ll determine by dividing the total number of products sold by the total variable costs incurred. You’ll often turn the best small business accounting software for 2021 to profit margin to determine the worth of your business. It’s an important metric that compares a company’s overall profit to its sales. However, if you want to know how much each product contributes to your bottom line after covering its variable costs, what you need is a contribution margin. The contribution margin is computed as the selling price per unit, minus the variable cost per unit.

Get this exclusive AI content editing guide.

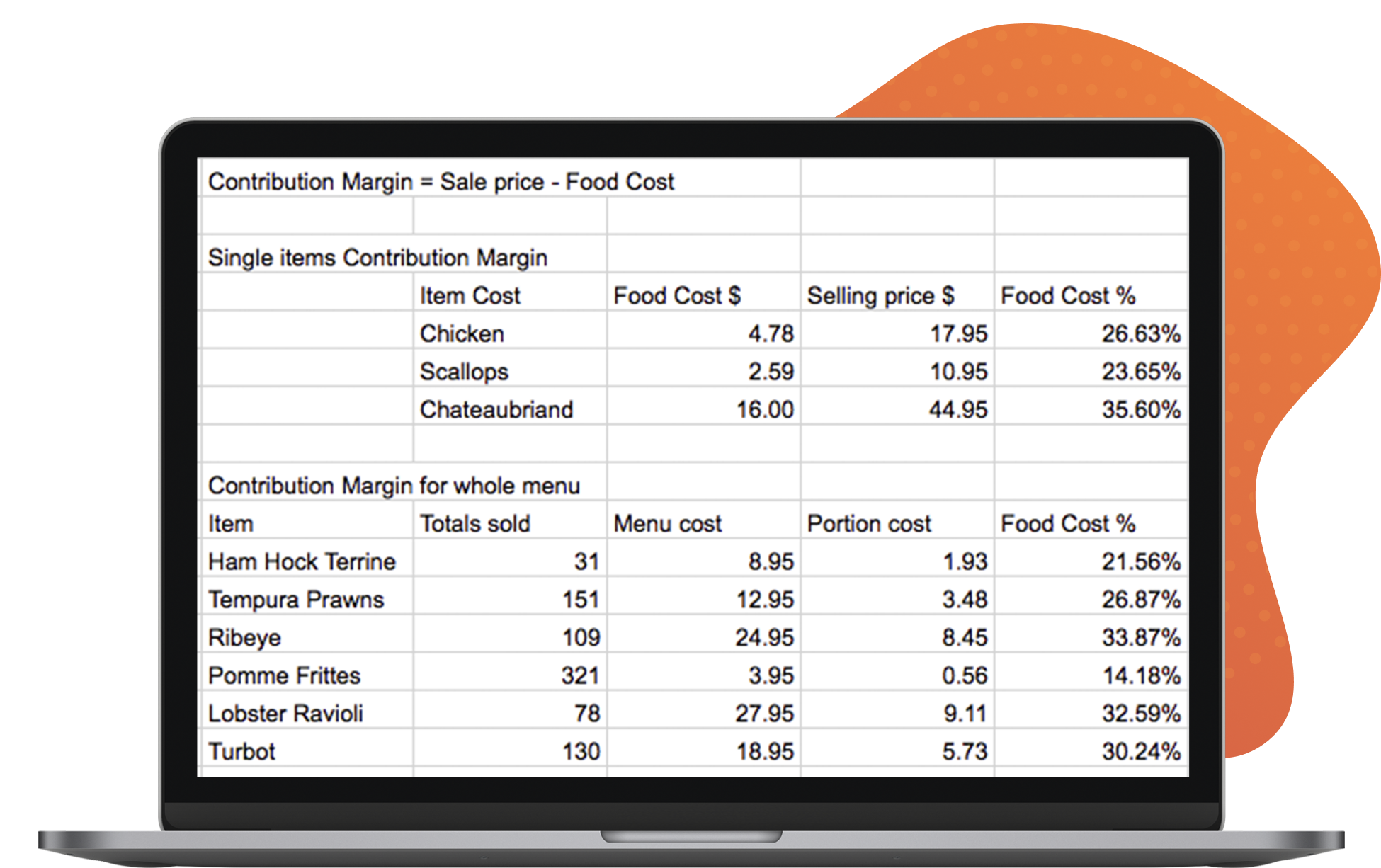

- Instead of doing contribution margin analyses on whole product lines, it is also helpful to find out just how much every unit sold is bringing into the business.

- It helps calculate how much revenue from sales contributes to covering fixed costs and generating profit after accounting for variable costs.

- For example, if your business sells a product for $100 per unit, and the variable cost per unit is $40, then for each unit sold, the contribution margin is $60.

- While it might sound similar to gross margin, contribution margin differs in its approach and utility.

If the selling price per unit is more than the variable cost, it will be a profitable venture otherwise it will result in loss. The Contribution Margin Ratio is a key financial metric that offers insights into the efficiency of your product line and sales strategy. It is expressed as a percentage and illustrates what portion of each sales dollar contributes to covering fixed costs and generating profit.

You can use this information to determine whether your business is profitable or not and whether it is growing or not (if your contribution margin percentage changes). The concept of contribution margin allows you to compare the relative profitability of two different products, two different services, two different market segments, or two different distribution channels. This concept also offers a means for evaluating the effectiveness of marketing spending and pricing strategies in achieving profit objectives.

Maximizing Profits: How to Analyze Contribution Margin for Business Success

Here, we are calculating the contribution margin on a per-unit basis, but the same values would be obtained if we had used the total figures instead. Thus, at the 5,000 unit level, there is a profit of $20,000 (2,000 units above break-even point x $10). A negative contribution margin tends to indicate negative performance for a product or service, while a positive contribution margin indicates the inverse. These can fluctuate from time to time, such as the cost of electricity or certain supplies that depend on supply chain status. Find out what a contribution margin is, why it is important, and how to calculate it.

You can use contribution margin to help you make intelligent business decisions, especially concerning the kinds of products you make and how you price those products. Imagine that you have a machine that creates new cups, and it costs $20,000. To make a new cup, you have to spend $2 for the raw materials, like ceramics, and electricity to power the machine and labor to make each product. The calculation of the contribution margin ratio is a three-step process. The best contribution margin is 100%, so the closer the contribution margin is to 100%, the better. The higher the number, the better a company is at covering its overhead costs with money on hand.

If you were to manufacture 100 new cups, your total variable cost would be $200. However, you have to remember that you need the $20,000 machine to make all those cups as well. The contribution margin is the leftover revenue after variable costs have been covered and it is used to contribute to fixed costs.

Some income statements report net sales as the only sales figure, while others actually report total sales and make deductions for returns and allowances. Either way, this number will be reported at the top of the income statement. 3) You can use contribution margins for setting prices for different services offered by your business. This will help you establish fair prices that are attractive for patients and cover the cost of providing care.

The contribution ratio is a measurement of your overall financial health. This means that if you sell 10 products, your total contribution would be $250. If your cost of goods sold was also $250, then you would achieve 100% contribution per sales ratio on that item. The analysis of the contribution margin facilitates a more in-depth, granular understanding of a company’s unit economics (and cost structure). As you can see, contribution margin is an important metric to calculate and keep in mind when determining whether to make or provide a specific product or service.