Companies sometimes do this to keep shareholders happy even if they hit a rough patch. This ratio is particularly important for investors looking for income-generating investments, as it provides insight into a company’s dividend sustainability and priorities in allocating income. The dividend payout ratio and share repurchases can both impact shareholder wealth. Companies need to strike a balance between rewarding shareholders and utilizing capital effectively for long-term value creation. Dividend reinvestment plans allow shareholders to automatically reinvest their dividends to purchase additional shares, enabling compounding of returns over the long term.

Ask a Financial Professional Any Question

However, ensuring the company can sustain its dividend payments is crucial to avoid potential dividend cuts or financial distress. A low payout ratio combined with a high dividend yield might indicate an undervalued stock with the potential for dividend growth. The payout ratio varies across industries due to differences in growth potential, capital requirements, and financial stability. It measures the percentage of earnings retained by the company for reinvestment or to pay off debt. However, it could also imply that the company has limited funds for reinvestment or growth.

- Besides the dividend payout assumption, another assumption is that net income will experience negative growth and fall by $10m each year – starting at $200m in Year 0 to $170m in Year 4.

- There’s no single number that defines an ideal payout ratio because the adequacy largely depends on the sector in which a given company operates.

- From a global view, dividend payout ratios vary across different regions due to cultural, economic, and regulatory factors.

- InvestingPro offers detailed insights into companies’ Payout Ratio including sector benchmarks and competitor analysis.

- The dividend payout ratio and share repurchases can both impact shareholder wealth.

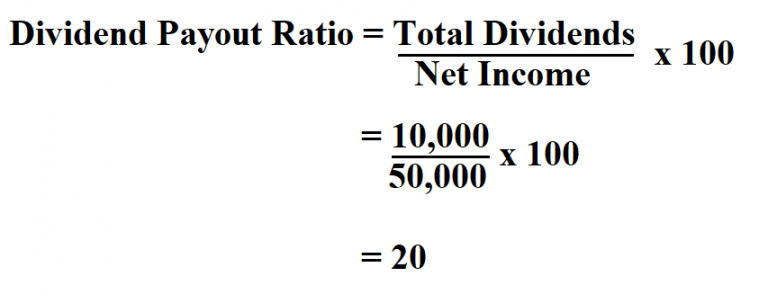

- The payout ratio is calculated by taking the dividends per share and dividing it by the earnings per share (EPS), with the result typically expressed as a percentage.

What is your current financial priority?

This is typically not a good recipe for the company’s financial health; it can be a sign that the dividend payment will be cut in the future. While the payout ratio can provide valuable insights, it is essential to compare companies within the same industry for meaningful analysis. Payout ratios vary across industries due to differences in growth potential, capital requirements, and financial stability. Comparing industry-specific benchmarks can help investors assess a company’s dividend policy and financial health relative to its peers. The payout ratio measures the proportion of earnings paid out as dividends to shareholders. A high payout ratio may signal a mature company with limited growth opportunities, while a low payout ratio may indicate a growing company with reinvestment potential.

Q. What is the primary purpose of the dividend payout ratio?

The dividend payout ratio can influence a company’s decision to initiate or increase share repurchase programs. A case study involving a company that modifies its dividend payout ratio provides insights into the factors driving the change and the subsequent impact on investor expectations and the company’s financial position. The adjusted dividend payout ratio takes into account factors such as extraordinary gains or losses, non-recurring items, and accounting adjustments that may affect the accuracy of the basic ratio. By considering these factors, the adjusted ratio provides a more accurate representation of a company’s regular dividend-paying capacity.

How to calculate the dividend payout ratio

A company in its initial stages of development might find it necessary to retain a larger part of the profit in the business to help it grow. Rather, reporting a “good” DPR is a balancing act as both high and low ratios have their pros motor vehicle sales and use tax and cons. Earnings per share are diluted in the formula because this is the most conservative view point. Investors who understand the DPR can make better decisions, avoid unnecessary risks, and improve the quality of their portfolios.

The payout ratio also helps to determine a dividend’s sustainability, as companies are generally reluctant to cut dividends. Below is a detailed guide to the dividend payout ratio, including how it’s used, why it matters, and how to calculate it. Local rules and regulations, particularly those imposed on listed companies by stock exchanges, also require companies to distribute adequate dividends to keep the interest of the shareholders alive. In any case, the overall trend as well as any sudden changes in the dividend payout ratio should be carefully analysed.

Helpful articles on different dividend investing options and how to best save, invest, and spend your hard-earned money. You must be a shareholder on or before the next ex-dividend date to receive the upcoming dividend. Note that there may be slight differences compared to the first formula’s calculation due to rounding and/or the exclusion of preferred shares, as only common shares are accounted for. Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

The dividend payout ratio is a financial metric used to determine the proportion of a company’s earnings that is distributed to shareholders in the form of dividends. It is calculated by dividing the total dividends paid out by the net income of the company. This ratio provides investors with valuable insights into how much of a company’s profits are being returned to shareholders. The payout ratio is a financial metric that measures the percentage of earnings a company pays out to its shareholders as dividends.

Also, higher dividend payments imply less money to fund business development initiatives and seize growth opportunities. Similarly, a high DPR can affect a company’s cash flow and liquidity, because dividends are paid in cash. From our example, it’s clear that Mature Industries Ltd., with a Dividend Payout Ratio of 50%, distributes a larger portion of its earnings as dividends compared to High-Tech Innovators Inc., which has a payout ratio of 20%.

Companies may experience stock price movements when they announce changes in their dividend payout ratios. Positive reactions may occur with dividend increases, while negative reactions may result from dividend cuts or omissions. From these examples, we can see that Company A has a lower dividend payout ratio of 50%, indicating that it retains more of its earnings for reinvestment or other purposes.

Different investor groups may have specific preferences for dividend payout ratios. For example, income-focused investors prefer higher payout ratios, while growth-oriented investors may favor companies that reinvest a larger portion of earnings. There are even times when investors should ignore dividend payout ratios all together, as certain companies will always have unusually high numbers. The payout ratio should not be applied to MLPs, Trusts, or REITs as they have a unique financial structure and are obligated to pay out most of their earnings as dividends.